We offer affordable, low-interest employment based loans up to $1,000 with no credit checks or collateral.

Unexpected expenses happen to everyone.

Surprise expenses can happen to anyone, but 58% of Americans don't have $1,000 in their bank account to cover these life events.

Tennessee has the most predatory lenders in the country.

There are more payday lenders in Tennessee than there are McDonald's locations.

In Tennessee, the annual percentage rate is 426% on payday loans.

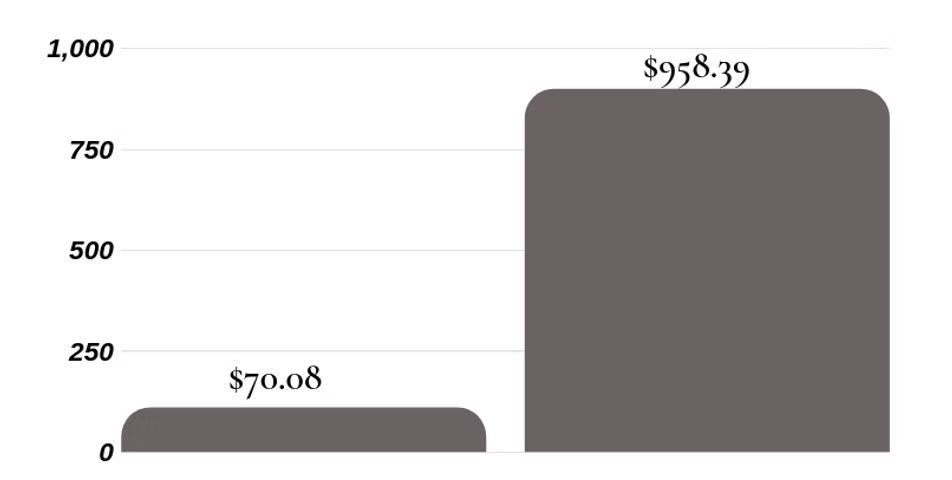

An average payday loan borrower is indebted 5 months out the year – this equates to paying $958.39 in fees to borrow $500 for 5 months.

At the Community Loan Center, we give borrowers 12 months to repay their loan with a fixed annual percentage rate of 21%.

Cost per $500 Borrowed

Community Loan Center

TN payday lender

Small Dollar Loans

A Better Alternative to High-Interest Pay Day Loans.

- Loans available from $400 - $1,000

- 18% fixed interest rate

- No credit history needed

- No collateral needed

- 12 month repayment, with no prepayment penalties

- Affordable monthly payments through convenient payroll deduction

- Loans can be used for any purpose

- Free financial education and counseling

Employers

How does the Small Dollar Loan program benefit employers?

Financially stable employees are more productive

100% free to employers, with minimal time to administer

Reduces associated costs with financial stress, including absenteeism and illness

Offer an innovative benefit to attract and retain talented employees

Decreases in employer turnover

Improves company morale

Borrowers

Don't get your financial future off track bytaking out a high-cost payday or title loan.

The Small Dollar Loan program can lend to those not eligible for bank and credit union loans that require credit checks.

We offer low-interest employment based loans, which are fixed to ensure affordable payments and greater financial security.

Why borrow with the Small Dollar Loan program?

Loans available from $400- $1,000

No hidden costs – 18% fixed interest, $20 origination fee

No credit check required

No prepayment penalties

Payback period - 12 months

Free financial education & counseling

To apply for a small dollar loan, please select your employer below.

Want to borrow from us, but your employer is not listed? Tell us! We'll contact your human resources representative and let them know about the program!

If you have questions or need more information, contact Michael Walker by email or phone.

mwalker@cneinc.org

423-756-6235

Faq

Frequently Asked Questions

Am I responsible for paying an employee’s loan if they no longer work for us?

No, you are never responsible for an employee’s outstanding loan. If an employee leaves a participating CLC employer, we simply will deduct the remaining payments directly from the borrower’s checking account that they provided us during the initial loan application.

Does participating in the Small Dollar Loan program cost money?

No, there is no fee to offer this innovative benefit to your employees. We would argue that offering the Small Dollar Loan program to your employees actually saves you money since financially stable employees are more productive, have a higher employment retention rate and have reduced costs associated with financial stress, such as absenteeism and illness.

How much time does it take to administer the Small Dollar Loan program?

We know that your time is valuable, that’s why we strive to ensure that offering the Small Dollar Loan program is not labor intensive for your HR Staff. We do this through offering an automated software program (KENN) that allows you to easily verify employment, set-up payroll deductions, utilize reports and stop payments once the loan is paid in full.

To assist you in promoting the Small Dollar Loan program, we provide you with marketing materials – including promotional flyers, template language for an email announcement, a Small Dollar Loan benefit sheet and we will happily host an in-person information session at your workplace.

How is the Small Dollar Loan program different than a Credit Union?

At the Community Loan Center, a borrower’s credit history does not factor into our decision to assist them with a Small Dollar Loan. If an employee is in need of money, the Small Dollar Loan program is easily accessible to them through their employer.

Our repayment period is 12 months, unlike many credit unions that have a 6 month payback period. Most credit unions require borrowers to be a member in order to take out a loan, but with the Small Dollar Loan program, a borrower must simply work for a participating employer, there is no membership required.

Do you pull my credit report when I apply for a loan?

No, we do not require credit checks on our Small Dollar Loans.

What happens to my loan payments if I change jobs?

If you leave your participating employer while you have a Small Dollar Loan, your scheduled loan repayments will be automatically drafted by us from your checking account, which you provide on your initial loan application. We will draft repayments from your checking account until your loan is paid in full.

Can I borrow additional funds?

Once you pay down half of your orginal loan balance, you can then apply for a new loan. However, a borrower can never have an outstanding loan over $1,000.

Are there any fees with the Small Dollar Loan?

There is a $20 loan fee that you must pay. This fee is built into your loan, so you do not have to pay any upfront costs with the Small Dollar Loan program. The $20 fee does not accrue interest and the re-payment is divided evenly over the 12 month repayment period.

Can you help me create a budget?

Yes! All Small Dollar Loan borrowers are eligible to receive free financial education with Chattanooga Neighborhood Enterprise. We offer a variety of educational opportunities to help meet your financial goals – these include our popular “Money School”, home buying workshops and meeting with a personal financial counselor.